10 Essential Marketing Strategies For Financial Services - Marketing In The Financial Sector

The marketing in the financial sectoris a fundamental pillar for the growth and sustainability of entities offering financial services. In an increasingly competitive and digitized market, marketing strategies become key tools to attract and retain customers, as well as to differentiate from the competition.

Importance of marketing in the financial sector Financial marketing not only helps institutions promote their products and services but is also essential for understanding and satisfying customer needs. In an environment where trust is an invaluable asset, effective marketing can build and maintain customer loyalty, positioning the brand as a leader in the sector.

Main Objectives Of Financial Marketing

The objectives of financial marketing are varied, but among the most prominent are:

- Increase brand and service visibility.

- Generate high-quality leads that can convert into customers.

- Improve customer experience through personalized services.

- Retain current customers by offering added value.

- Educate the market about available financial services and how they can benefit.

Challenges And Regulations In Financial Services Marketing

Marketing in the financial field faces unique challenges. Strict regulation is one of the main obstacles, as entities must ensure that their marketing strategies comply with current laws and regulations. Additionally, they must deal with the sensitivity of the information they handle and the need to protect their customers' privacy.

Challenges include:

- Navigating a complex regulatory framework without compromising creativity.

- Maintaining information security in all marketing campaigns.

- Adapting to technological evolution and changing customer expectations.

- Differentiating in a saturated market where financial products may seem similar to the average consumer.

Big Data And Predictive Analytics In Finance

In the world of financial services, Big Data and predictive analytics have revolutionized how institutions understand and relate to their customers. These tools allow companies not only to collect large volumes of information but also to analyze it for valuable insights that drive strategic decision-making.

Collection And Analysis Of Customer Behavior Data

Data collection is essential to understand customer needs and preferences. Financial institutions use various sources, such as transactions, online interactions, and surveys, to create detailed profiles of their users. By analyzing this data, companies can identify behavior patterns and tailor their services to better meet customer expectations.

For instance, should a bank observe a particular customer segment consistently seeking details about home loans on its website, tailored marketing initiatives can be crafted exclusively for these users. By providing pertinent and personalized content related to mortgages and real estate financing, the bank can enhance its engagement with this audience. Discover more about the significance of such strategies in the realm of mortgagesat MLCalc.

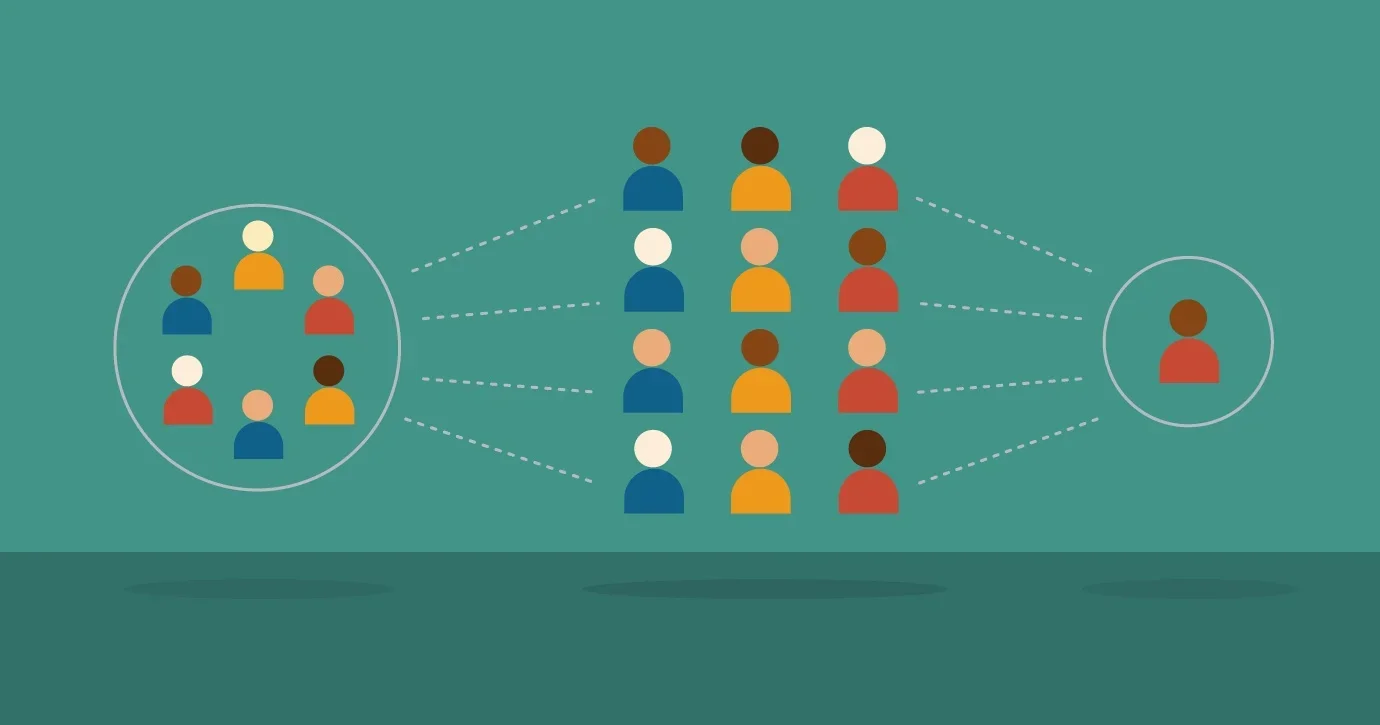

Segmentation And Customization Of Offerings

Segmentation is the process of dividing the customer base into smaller groups with similar characteristics. This allows financial institutions to customize their offerings and communications. For example, younger customers might be more interested in savings products and student loans, while older customers might prioritize investments and retirement plans.

Customization goes a step further, adapting the experience and offers at an individual level. With the help of Big Data, banks can, for instance, offer personalized interest rates based on the customer's credit and financial history, thus increasing the chances of conversion.

Prediction Of Trends And Buying Behaviors

Predictive analytics uses algorithms and mathematical models to forecast future behaviors and trends based on historical data. In the financial sector, this can mean anticipating when a customer might need a personal loan or identifying the risk of a customer ceasing to use the bank's services.

These predictions allow financial institutions to be proactive in their marketing approach. Instead of reacting to customer actions, they can anticipate their needs and offer solutions before the customer looks for alternatives elsewhere.

The use of Big Dataand predictive analytics in financial services marketing not only improves the customer experience but also enhances operational efficiency and the profitability of institutions. By better understanding their customers and anticipating their needs, companies can design more effective marketing strategies and gain a competitive advantage in the market.

Multichannel Strategies And Fintech

In the world of financial services, adapting to new technologies and the ability to reach customers through multiple channels are key factors for success. Multichannel strategies and the integration of Fintech solutions have revolutionized how financial institutions communicate with their audience and offer their products.

Effective communication through various channels Multichannel communication involves using different platforms and media to interact with customers. This includes traditional channels such as physical branches, telephone support, and postal mail, as well as digital channels like email, social media, mobile apps, and websites. The key is to offer a consistent and high-quality experience at all touchpoints.

- Email: Sending personalized newsletters and service alerts.

- Social media:Interactive posts and real-time customer support.

- Mobile apps:Quick and secure access to financial services.

- Websites:Informational portals and account management platforms.

Integration Of Fintech Technologies In Marketing

Fintech technologies have transformed the financial sector, offering innovative solutions that enhance the customer experience. Integrating these technologies into marketing strategies allows financial companies to offer more efficient and personalized services. Some of these technologies include:

- Mobile payments and e-wallets: Facilitate fast and secure transactions.

- Blockchain: Increases transparency and security in operations.

- Robo-advisors:Provide automated and personalized financial advice.

- Crowdfunding and P2P lending: Offer alternative funding and lending options.

Frictionless Digital Experiences For The User

To capture and retain customers in the financial sector, it is essential to provide frictionless digital experiences. This means that processes must be intuitive, fast, and, above all, secure. Customers expect to be able to carry out financial transactions seamlessly, whether from their computer or mobile device.

- Responsive design: Ensures platforms work seamlessly on any device.

- Biometric authentication: Offers an additional level of security and convenience.

- Chatbots and virtual assistants:Provide immediate assistance and query resolution.

- Intuitive user interfaces: Facilitate navigation and the use of financial services.

By Implementing Multichannel Strategies And Leveraging

Fintech innovations, financial institutions can significantly improve their reach and effectiveness in marketing. This not only drives sales and growth but also enhances customer satisfaction and loyalty, fundamental aspects in an increasingly competitive market.

Creation Of Relevant And Educational Content

The content generated by financial entities should be not only attractive but also informative and easy to understand. Blog articles, infographics, videos, and webinars are some of the formats that can be used to explain topics such as stock investment, retirement savings, or debt management. By providing this valuable information, financial institutions position themselves as experts and build a trusting relationship with their customers.

Building Customer Trust And Loyalty

Financial education not only helps customers better understand products and services but also fosters trust and loyalty toward the brand. A customer who feels informed and empowered to make financial decisions is more likely to remain loyal to a company that has supported them in their learning process. Moreover, trust translates into a greater willingness to recommend services to friends and family, thereby expanding the company's reach.

Strategies To Connect With The Young Audience

Today's youth are tomorrow's investors. Connecting with this audience is crucial for financial institutions looking to ensure their long-term relevance. Social media and mobile apps are effective channels to reach this demographic, which values accessibility and immediacy of information. Additionally, topics related to personal finance and entrepreneurship are often of great interest to the young audience, making focusing content on these aspects a successful strategy.

Techniques And Tools For Success In Financial Marketing

Financial marketing is a field that requires a strategic combination of techniques and tools to achieve success. In this section, we will explore some of the most effective ones to stand out in the competitive world of financial services.

Precision Marketing

Precision Marketing is a technique based on using data to target specific customers with highly relevant messages. In the financial sector, this means analyzing customer behavior and needs to offer products that truly align with their expectations and financial situation.

- Advanced Segmentation:Use demographic, psychographic, and behavioral information to create customer groups with similar needs.

- Personalization:Adapt messages and offers to each customer, increasing the probability of conversion.

- Marketing Automation:Implement systems that allow sending personalized communications at the right time.

Cost, Differentiation, And Segmentation-Based Strategies

Financial services companies can adopt different strategies to position themselves in the market:

- Cost Leadership:Offer the most economical financial services in the market to attract a price-sensitive customer base.

- Differentiation:Create unique services or distinctive features that set them apart from the competition.

- Segmentation:Focus on specific market niches, offering specialized services that meet their particular needs.

Use Of Social Media And Customer Outreach

Social media is a powerful tool for financial institutions, allowing them to interact with customers and reach wider audiences.

- Engagement:Publish content that generates interaction and encourages user participation.

- Targeted Advertising:Leverage platform segmentation options to reach specific groups with advertisements.

- Customer Service:Use social media as a fast and efficient customer service channel.

ROI Evaluation And Continuous Campaign Improvement

To ensure that marketing strategies are effective, it is crucial to measure the return on investment (ROI) and make constant adjustments.

- Metrics Analysis:Monitor key indicators such as conversion rate, cost per acquisition, and customer lifetime value.

- A/B Testing:Conduct comparative tests to optimize campaigns and improve customer response.

- Customer Feedback:Collect and analyze customer opinions to better understand their needs and improve the services offered.

Marketing In The Financial Sector - People Also Ask

What Is The Role Of Marketing In The Financial Sector?

The role of marketing in the financial sector is multifaceted and crucial for the growth and sustainability of financial institutions. Marketing serves several key purposes in finance:

- Promotion of Products and Services:Marketing helps financial institutions promote and create awareness about their various products and services, such as loans, credit cards, investment opportunities, and insurance plans.

- Building Brand Visibility and Trust:Establishing a strong brand presence is vital in the financial sector. Marketing efforts contribute to building trust and credibility, as customers are more likely to engage with institutions they perceive as reliable and reputable.

- Understanding and Meeting Customer Needs:Marketing in finance involves market research to understand customer needs, preferences, and behaviors. This insight is used to tailor financial products and services to better meet customer expectations.

- Customer Acquisition and Retention:Marketing strategies aim to attract new customers (customer acquisition) and retain existing ones. Effective marketing can contribute to customer loyalty, reducing customer churn and fostering long-term relationships.

- Educating the Market:Given the complexity of financial products and services, marketing plays a significant role in educating the market. This involves explaining the benefits and features of various financial offerings, helping customers make informed decisions.

- Compliance with Regulations:Financial marketing operations must adhere to strict regulations. Marketing professionals in the financial sector need to ensure that their strategies comply with legal and regulatory frameworks to maintain the institution's reputation and avoid legal issues.

What Does Marketing Do For Finance?

- Digital Marketing:Leveraging online channels, social media, and email marketing to reach a wider audience, generate leads, and promote financial products.

- Content Marketing:Creating informative content, such as blog posts, articles, and videos, to educate customers about financial topics, build trust, and position the institution as an industry authority.

- Data Analytics:Utilizing data analytics to understand customer behavior, preferences, and market trends. This information guides decision-making and helps in crafting targeted marketing campaigns.

- Customer Relationship Management (CRM):Implementing CRM systemsto manage interactions with customers, track leads, and personalize marketing efforts based on customer profiles.

- Compliance Management:Ensuring that marketing activities adhere to regulatory requirements and industry standards, including transparency in advertising and protection of customer information.

What Are The Marketing Operations In Financial Services?

Marketing in the financial sector plays a pivotal role in promoting financial products, building trust, educating customers, and ensuring compliance with regulations. It involves a diverse set of operations aimed at acquiring and retaining customers while navigating the unique challenges of the financial industry.

Conclusion

By implementing these techniques and tools, financial services companies can significantly improve their market presence and customer satisfaction. The key lies in constant adaptation and continuous learning to stay up-to-date with consumer trends and expectations. With a strategic approach and effective use of technology, financial marketing can become a driver of growth and customer loyalty.